It is not always you are borrowing money from the bank, sometimes you borrow money from your family, or perhaps even lend money to a friend. This How-To chapter will describe one way to handle lending money to a friend.

We are basing this How-To on the following generic account structure.

-Asset

-Bank

-Bank Account

-Money owed to you

-Person

-Income

-Interest Income

-PersonThis example will show how to track a personal loan of 2,000 USD (default currency) to your friend Peter.

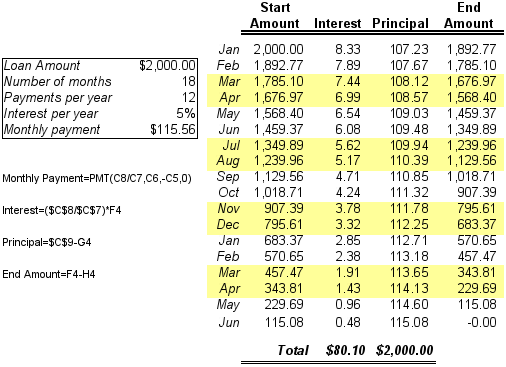

Peter wants to borrow $2,000 dollars from you and plans to pay you back monthly for the next 18 months. Since he is your friend, (but not that close) you both agree on a yearly interest rate of 5%.

In summary we have the below details. Peter’s loan details:

Principal Amount - $2,000

Term - 18 months with 12 payments per year

Annual Percentage Rate: 5%

Monthly Payment : ??

So how do you calculate the Monthly Payment?

You have a number of different options, like paper and pen, Linux Calculator, Apache OpenOffice/LibreOffice

Calc module, but the easiest is to use GnuCash Loan

Repayment Calculator. This tells you that the Monthly Payment should be

$115.56.

But you need to know how much of this is Interest and how much is Principal to be able to do a

proper bookkeeping. For this you need a more powerful tool, something like the

Calc module in Apache OpenOffice/LibreOffice, and in particular the

PMT function.

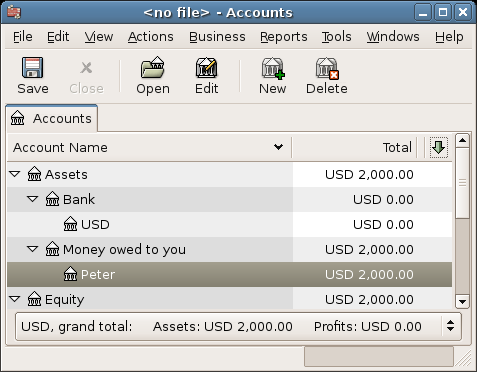

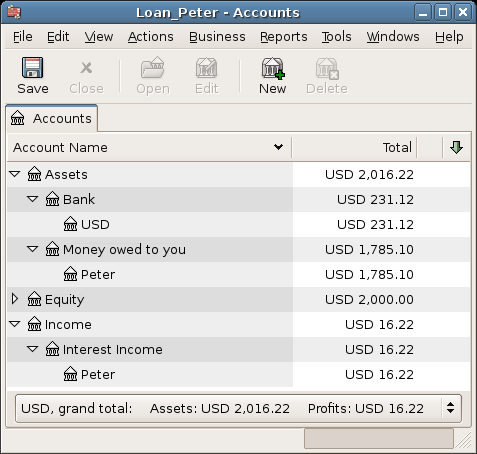

Let’s start with the following accounts. They all have the same currency, in this case USD.

Example 8.1. Accounts for the loan to Peter

- Assets:Bank:USD

- Assets:Money owed to you:Peter

- Income:Interest Income:Peter

- Equity:Opening Balances:USD

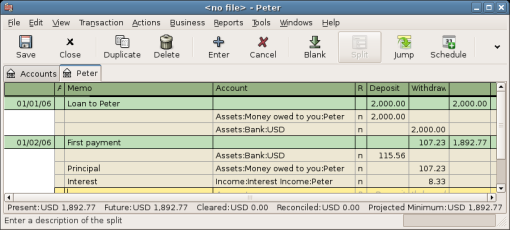

When you have lent money to your friend, you have in fact moved money from an Asset account (like Bank, Checking or similar) to your Asset account Money owed to you. To record this you enter the following transaction into the Assets:Money owed to you:Peter account.

Table 8.2. Personal loan to Peter

| Account | Increase | Decrease |

| Assets:Money owed to you:Peter | $2,000 | |

| Assets:Bank:USD | $2,000 |

When the first payment ($115.56) is received, you will need to determine how much is for the principal loan, and how much is for the loan interest.

Outstanding loan amount this period = $2,000

Payment per month = $115.56

Payment breakdown

5%/12 * $2,000 = $8.33 Interest

$115.56 - $8.33 = $107.23 Principal

This can be translated to the following GnuCash entry

The balance on Peter’s loan is now $2,000 - $107.23 = $1,892.77.

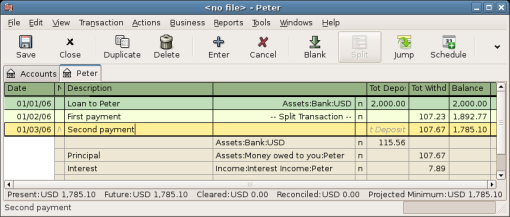

When the second payment ($115.56) is received, you will again need to determine how much is for the principal loan, and how much is for the loan interest.

Outstanding loan amount this period = $1,892.77

Payment per month = $115.56

Payment breakdown

5%/12 * $1,892.77 = $7.89 Interest

$115.56 - $7.89 = $107.67 Principal

This can be translated to the following GnuCash entry.

The balance on Peter’s loan is now $1,892.77 - $107.67 = $1,785.10.

The Chart of accounts looks now like this:

As you can see, the interest varies for every month, as well as the principal amount. So for every payment you receive you need to calculate the proper amounts for your various split entries.

The interest amount will be less and less for every payment (since it is calculated on a smaller loan amount all the time), until the last payment where it is more or less 0. Please review Detailed view over the private loan to Peter for more details.