Companies may split their stock for many reasons but the most common is that the price has risen higher than management thinks is a reasonable price for many investors. Some of these splits are simple exchanges (for example, 2 for 1 or 3 for 2) and some are complex exchanges with cash distributions. Splits may also result in fewer shares if the exchange rate is a reverse split (1 for 3 or 0.75 for 1).

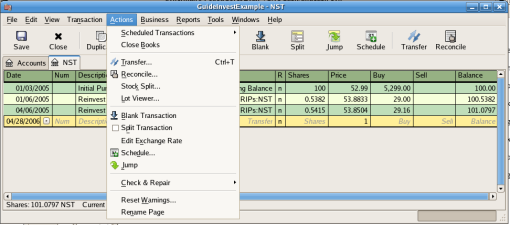

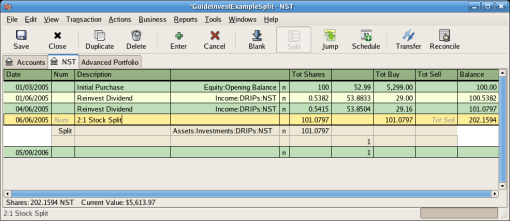

As an example, our holding of NST stock declared a 2 for 1 stock split effective June 6, 2005. The process for entering this transaction is; select → to start the assistant.

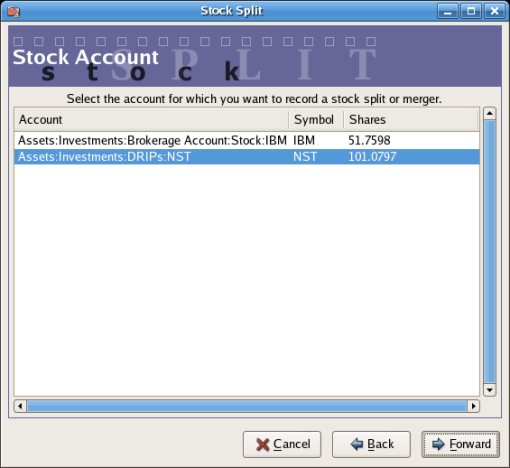

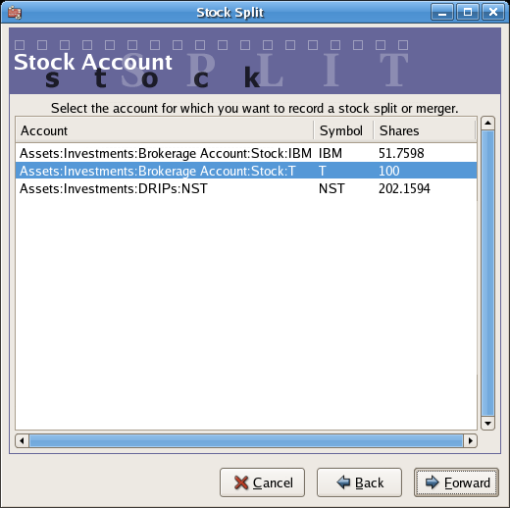

The first screen is an Introduction, select to display the selection of the account and stock for the split. You will need to create an entry for each Account:Stock combination you hold.

Select the Assets:Investments:DRIPs:NST and click on .

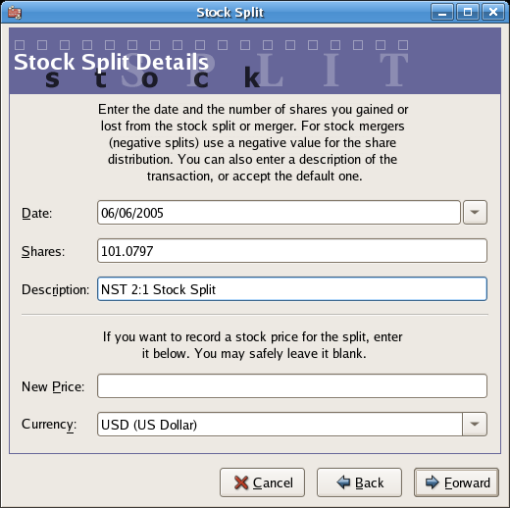

The next screen presents 5 fields in the Stock Splits Details window:

- Date

- Enter the date of the split.

- Shares

The number of shares increased (or decreased) in the transaction. In this example, it is a 2 for 1 split so the number of additional shares is the number of shares currently in the register.

- Description

- The Description should give a brief explanation of the transaction.

- New Price

- If desired the new price of the stock, after the split, may be entered.

- Currency

- The currency of the transaction is required. This should be the same as the stock purchase currency.

Click on the button.

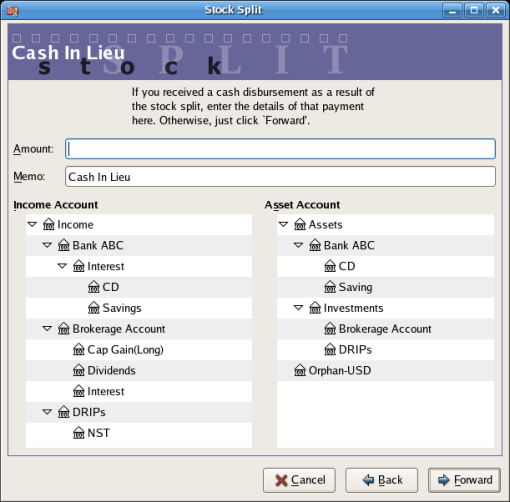

The next screen will be skipped in this example as there was no “Cash in Lieu”.

A final Finish screen will give a last option to; , to modify any data entered or to complete the stock split with the data entered.

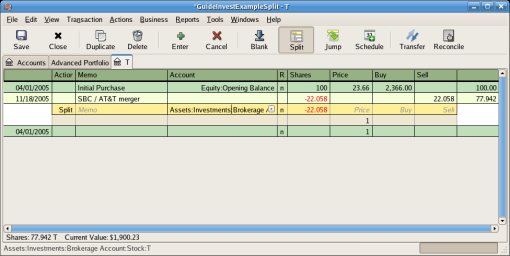

As an example, assume you held AT&T stock during the Nov. 18, 2005 merger of SBC with AT&T. For this example you will have purchased AT&T on April 1, 2005, any dividends will have been paid in cash, therefore not entered into the AT&T stock register.

The conditions of the merger were 0.77942 share of SBC stock were exchanged for each share of AT&T stock. The merged company continued to use the symbol “T” from AT&T.

AT&T paid a “dividend” of $1.20/share on the transaction date, however this will not appear in the stock account as it was a cash distribution.

The process for entering this transaction is identical to the simple split until the “Details” screen. You will need to create an split entry in each Investment Account:Stock account combination that has shares splitting.

Select the Assets:Investments:Brokerage Account:Stock:T and click on .

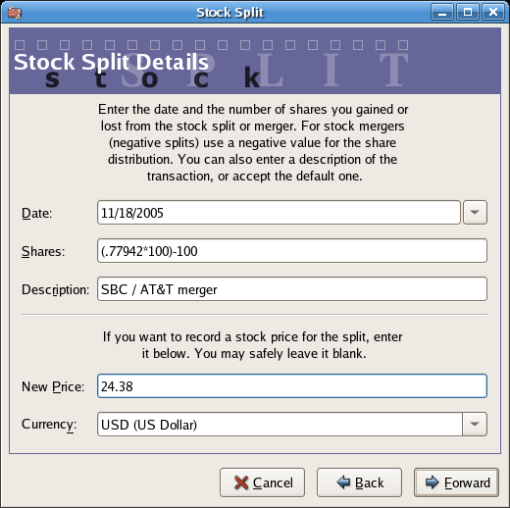

The next screen presents 5 fields in the Stock Splits Details window:

- Date

- Enter the date of the split. Here we’ll enter November 18, 2005.

- Shares

The number of shares increased (or decreased) in the transaction. In this example it is a 0.77942 for 1 split so the number of shares will decrease from the number of shares currently in the register. You may use

GnuCash’s ability to perform calculations on an entry form by entering data directly (0.77942*100 − 100) to calculate the decrease in shares from the split.- Description

- The Description should give a brief explanation of the transaction.

- New Price

- If desired the new price of the stock, after the split, may be entered.

- Currency

- The currency of the transaction is required. This should be the same as the stock purchase currency.

Click on the button.

The next screen will be skipped in this example as there was no “Cash in Lieu”.

A final “Finish” screen will give a last option to to modify any data entered or to complete the stock split with the data entered.