Most payments to your credit card bill are entered as transfers from a bank account (asset) to the credit card account (liability). When you pay the monthly bill, you are withdrawing money from a bank account to pay down the credit card balance. This transaction decreases both your bank account balance and the amount of credit card debt you owe.

When you return a purchase, you receive a refund on your credit card. This is another type of payment in that it decreases the amount of credit card debt you owe. If you recorded the original purchase transaction as a transfer from the credit card account to the expense, you now simply reverse that transaction: transfer the money back from the expense to the credit card account. This transaction decreases both the expense account balance and the credit card account balance. For example, if you originally recorded a credit card purchase of clothing, the transaction is a transfer from the credit card account to the clothing expense account. If you then return that clothing for a refund, you simply transfer the money back from the clothing expense account to the credit card account.

| Note |

|---|---|

A common mistake is to enter a refund as income. It is not income, but rather a “negative expense”. That is why you must transfer money from the expense account to your credit card when you receive a refund. | |

To clarify this, let’s run through an example. You bought some jeans for $74.99 on your VISA card, but realized one day later that they are too big and want to return them. The shop gracefully agrees, and refunds your credit card.

Start with opening the previous datafile we stored (

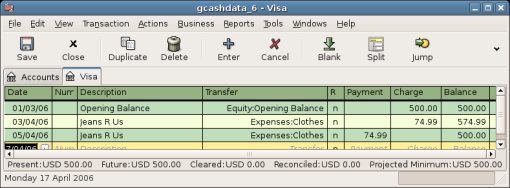

gcashdata_5), and store it asgcashdata_6.Open the Liabilities:Visa account register and enter a simple 2 account transaction to pay the $74.99 jeans purchase. The Transfer account should be Expenses:Clothes and you Charge your Visa account with the $74.99.

Note Since we had not created the Expenses:Clothes account previously,

GnuCashwill prompt us to create it. Just remember to create it as an Expense accountEnter the refund in one of the following way.

Enter the same transaction as the purchase transaction, but instead of a “Charge” amount, use a “Payment” amount in the Credit Card account register.

Select the purchase transaction you want to refund (that is the Jeans transaction in our case), and selecting → . Modify the date as needed.

After reversing the transaction, your credit card account should look something like this:

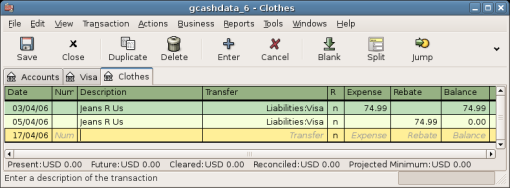

And the Expenses:Clothes register should look something like this:

Save the

GnuCashdata file.